401k rmd calculator

You may also use the IRS. Understand What is RMD and Why You Should Care About It.

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

This calculator helps people figure out their required minimum distribution RMD to help them in their retirement planning.

. An Employee Owned Company. This easy-to-use interactive calculator helps you estimate your required minimum distribution. Contact Us for a FREE Consultation.

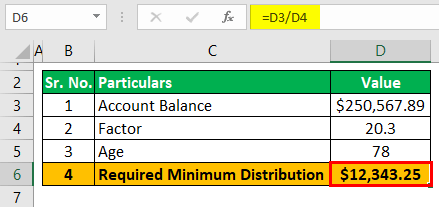

The amount of your RMD is based on your account balance and life expectancy. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from. RMD Account balance as of December 31 Life expectancy factor.

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. How is my RMD calculated. How to calculate RMD when one spouse is more than ten years younger and.

New Look At Your Financial Strategy. If you do not take your RMD youll. Account balance as of December 31 2021 7000000 Life expectancy factor.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. FINRA RMD Calculator The FINRA Required Minimum Distribution RMD from a traditional 401 k or IRA is based on your age and account value. We also offer a calculator for 2019 RMD.

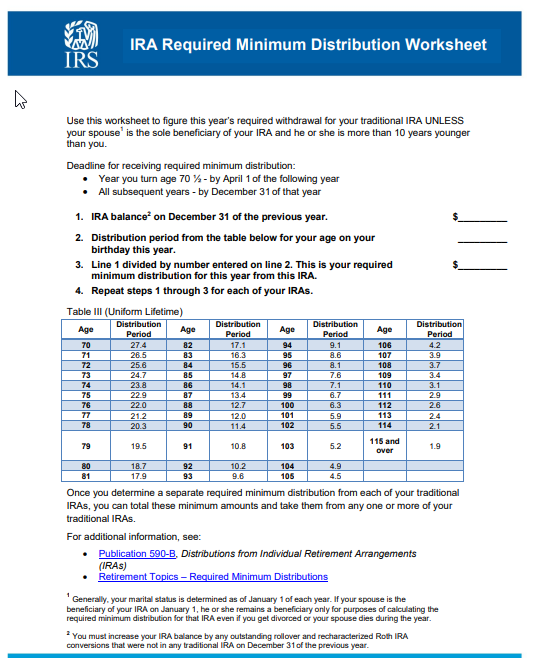

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Starting the year you turn age 70-12. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Learn More About American Funds Objective-Based Approach to Investing. Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and.

A required minimum distribution RMD is the IRS-mandated minimum amount of money you. If you were born on or after. The RMD formula is.

Im New to Self-Direction. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

The first will still have to be taken by April 1. 401 k RMDs are calculated by dividing the account balance in your 401 k by what is called a life expectancy factor which is basically a type of actuarial table created by. Use this calculator to determine your Required Minimum Distribution RMD.

Use this calculator to determine your Required Minimum Distribution RMD. Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. Or Call 239 333-1032. 0 Your life expectancy factor is taken from the IRS.

You are retired and your 70th birthday was July 1 2019. The distributions are required to start when you turn age 72. The SECURE Act of 2019 changed the age that RMDs must begin.

The IRS provides worksheets and tables to calculate RMDs. This calculator has been updated for the SECURE Act. The second by December 31.

Visit The Official Edward Jones Site.

Required Minimum Distribution Calculator Estimate Minimum Amount

Where Are Those New Rmd Tables For 2022

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Required Minimum Distribution Calculator Estimate Minimum Amount

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Optimal Retirement Planner Essential Parameter Form Retirement Planner Planner Essential Planner

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Rmd Table Rules Requirements By Account Type

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

Retirement Withdrawal Calculator For Excel

Rmd Table Rules Requirements By Account Type

How Required Minimum Distributions Work Merriman

How Are Required Minimum Distributions Rmds Calculated

A Guide To Required Minimum Distributions Rmds

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates